Cryptocurrency Trends: NFTs, Stablecoins, and DeFi

The digital asset market is filled with a diverse range of players, each bringing their unique strengths and perspectives to the industry. Established financial institutions such as JPMorgan Chase and Goldman Sachs have entered the space, recognizing the potential for growth and innovation in digital assets. These traditional players are leveraging their vast resources and experience to navigate the regulatory landscape and offer new financial products to their clients.

Alongside these established giants are a multitude of startups and tech companies making a mark in the digital asset market. Companies like Coinbase and Binance have become household names in the world of cryptocurrency exchanges, providing users with platforms to buy, sell, and trade digital assets. These innovative players are constantly evolving to meet the changing demands of the market, driving the adoption and integration of digital assets into mainstream finance.

Market Volatility and Risk Management Strategies

Market volatility in the digital asset market is a common occurrence, presenting both opportunities and challenges for investors. Sharp price fluctuations, often driven by external factors such as regulatory announcements or global economic events, can lead to significant gains or losses within a short period of time. In this dynamic environment, it is crucial for market participants to implement effective risk management strategies to protect their investments.

One of the key risk management strategies in the face of market volatility is diversification. By spreading investments across multiple digital assets with different risk profiles, investors can mitigate the impact of price fluctuations on their overall portfolio. Additionally, setting clear stop-loss and take-profit levels can help investors limit potential losses and secure profits. It is essential for market players to continuously monitor market conditions and adjust their risk management strategies accordingly to navigate the ever-changing landscape of the digital asset market.

• Diversification is a key risk management strategy

• Spread investments across digital assets with different risk profiles

• Setting clear stop-loss and take-profit levels can help limit losses and secure profits

• Continuously monitor market conditions and adjust strategies accordingly

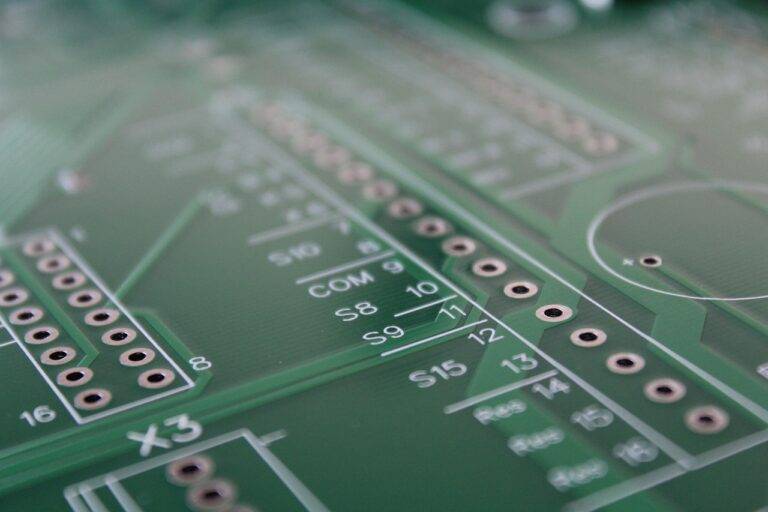

Innovative Blockchain Applications

Blockchain technology is significantly transforming various industries beyond just cryptocurrencies. One innovative application of blockchain is in the realm of supply chain management. By utilizing blockchain’s decentralized and immutable nature, companies can achieve greater transparency and traceability throughout their supply chains. This helps in verifying the authenticity of products, enhancing consumer trust, and mitigating issues like counterfeiting and fraud.

Another fascinating application of blockchain technology is in the field of healthcare. By securely storing patient data on the blockchain, healthcare providers can ensure the integrity and privacy of sensitive information. Moreover, blockchain can streamline processes like sharing medical records among different healthcare providers, ultimately improving the quality of patient care and reducing medical errors. This innovative use of blockchain has the potential to revolutionize the healthcare industry by prioritizing data security and interoperability.

What are some of the major players in the digital asset market?

Some major players in the digital asset market include Bitcoin, Ethereum, Ripple, and Litecoin.

How can market volatility be managed in the digital asset market?

Market volatility can be managed through various risk management strategies such as diversification, setting stop-loss orders, and utilizing hedging techniques.

What are some innovative blockchain applications?

Innovative blockchain applications include smart contracts, supply chain tracking, identity verification, and decentralized finance (DeFi) platforms.